Summer Credit Card Bonuses Worth 100K+ in 2025

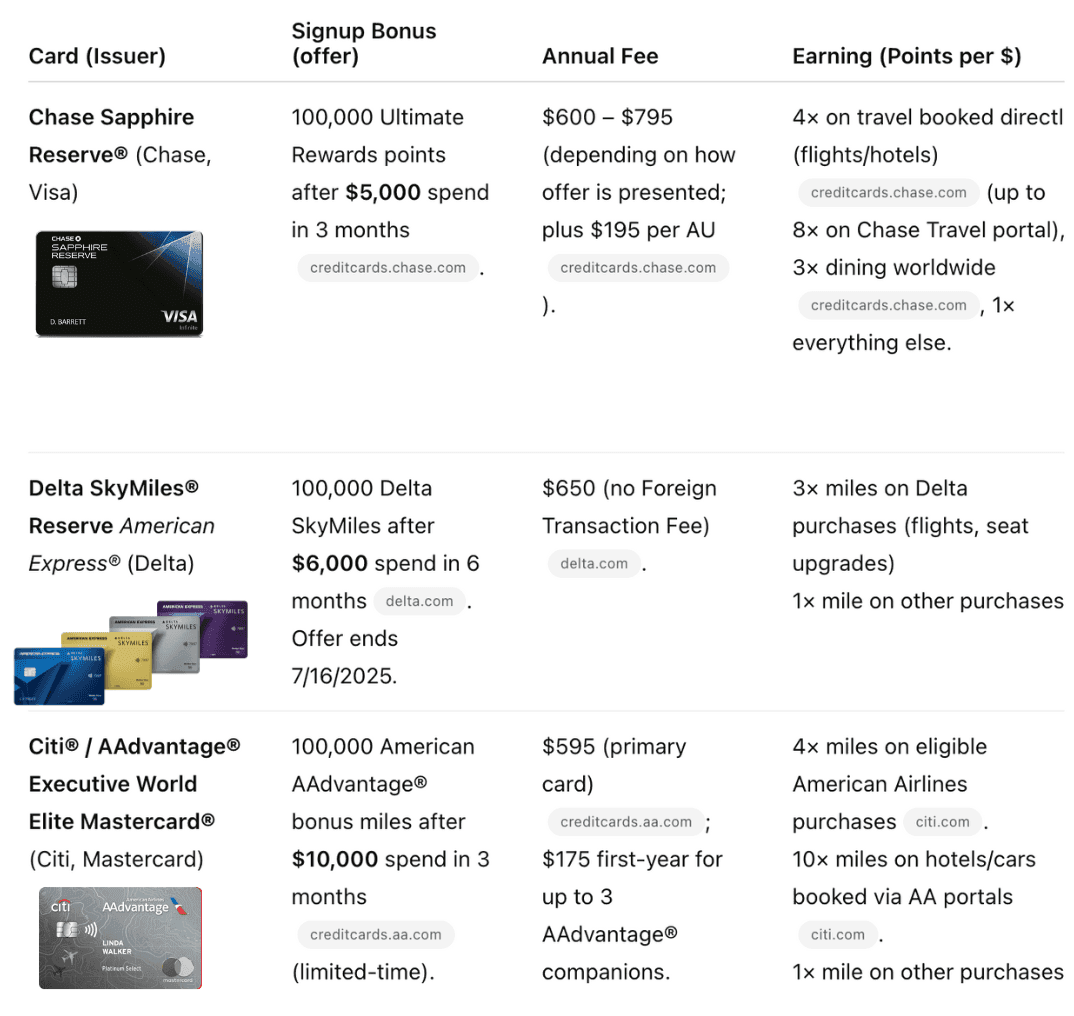

Looking to score a huge pile of travel points this summer? Several top issuers are offering 100,000 points (or miles) bonuses on their best travel cards. In this roundup, we compare three standout cards, one from Chase, one from American Express (co-branded with Delta), and one from Citi, each of which currently advertises a 100K+ signup offer on its official site. Below, you’ll find an easy-to-scan comparison chart followed by friendly summaries of each card’s offer, perks, and trade-offs.

Chase Sapphire Reserve® Bonus: 100,000 Chase Ultimate Rewards® points after spending $5,000 in 3 months. This is one of Chase's most generous current offers on a personal card. Main Perks: Chase Reserve is loaded with travel benefits. It offers 8× points on travel booked through Chase Travel (including a special hotel collection) and 4× on dining. There's a $300 annual travel credit (applied to any travel purchases) and up to $500 in extra travel credits for stays booked through Chase's "The Edit" hotel portal. You also get Priority Pass™ lounge membership (access to 1,300+ lounges worldwide), plus credits for Global Entry/TSA PreCheck, a $300 annual dining credit, and more. Downsides: The Sapphire Reserve has a very high annual fee (on the order of ~$550; official materials now show $795, which may bundle in partner/authorized user fees). You must spend $5K quickly to earn the bonus. Also, the rewards shine most when booking premium travel or using Chase's travel portal; otherwise, your points (and annual credits) may not stretch as far as simpler cashback.

Delta SkyMiles® Reserve American Express Card Bonus: 100,000 Delta SkyMiles after spending $6,000 in 6 months (promotion valid through July 16, 2025). This is a limited-time Amex/Delta offer for this top-tier Delta card. Main Perks: This is Delta's flagship personal card. It earns 3× miles on Delta purchases (1× on other buys). Key perks include Sky Club lounge access on Delta flights (15 free visits per Medallion year) plus access to The Centurion® Lounge and Escape Lounge when you buy your Delta ticket with the card at delta.com. You also receive an annual companion certificate for a free Main Cabin round-trip on Delta and enjoy a waived first checked bag and priority boarding on Delta flights. Additional benefits include statement credits for rideshares and Delta hotel stays. Downsides: The big drawback is the $650 annual fee, and you must spend $6,000 quickly to get the bonus. If you don't fly Delta much, you'll miss out on the lounge and companion value. The earned miles are most useful on Delta/Air France-KLM flights, so redemption options are narrower than with flexible points.

Citi / AAdvantage Executive World Elite Mastercard® Bonus: 100,000 American AAdvantage® miles after $10,000 in purchases in 3 months (limited-time offer). Citi's Executive Mastercard is the premium AA card and currently touts this very large bonus. Main Perks: The standout perk is Admirals Club® membership (up to ~$850 value) for the primary cardholder; it's the only consumer AA card with lounge access. You also earn 4× AA miles on American Airlines purchases (and 5× total on AA after $150K spent) and 10× miles on eligible car rentals and hotels booked via AA's sites. Additional benefits include a free first checked bag (for you + 8 companions) and priority boarding, as well as Global Entry/TSA PreCheck fee credits. Card spending also earns "Loyalty Points" toward AA elite status. Downsides: The card has a $595 annual fee, making it only worth it if you value AA status perks and lounges. You must spend $10K for the bonus, and most bonus miles come as AA miles (less flexible than transferable points). If you're not an American flyer, many of the perks won't apply.

Sources: All offers and benefits are quoted from the card issuers' official sites: creditcards.chase.com, creditcards.aa.com, and delta.com. Each card's current promotion is confirmed on the issuer's website as of summer 2025.